Understanding mortgage financing can be difficult, it doesn't have to be, here's the plan!

STEP ONE

Connect with us!

The process starts when you let us know you'd like to talk about your mortgage. We're happy to take a look at your financial situation and put together a plan for your first/next mortgage!

STEP TWO

Discuss your options.

When it comes to mortgage financing, you have a lot of options! When you work with us, we clarify those options, so you can make the decision that best suits your needs.

STEP THREE

Arrange the paperwork.

Handling the paperwork is the nitty gritty of mortgage financing. And this is where we shine!

We make sure you know exactly what is required

of you at every step, limiting any delays.

STEP FOUR

Lifetime support.

We've worked with clients just like you for over 20 years.

We're not going anywhere! So as long as you need a mortgage, you can trust that

our team will be there for you!

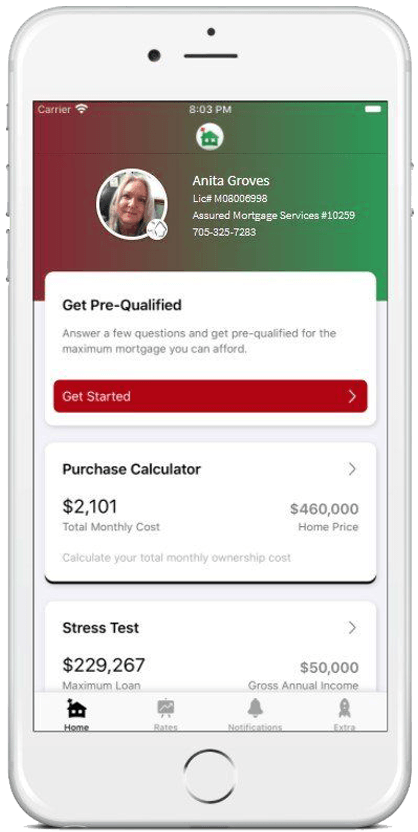

Hello, I’m Anita. Thanks for visiting me online. My team and I absolutely love arranging mortgage financing for people like you; it’s our passion. If you're looking to purchase or refinance your existing home or investment property, I specialize in providing customized solutions for my clients. You've come to the right place!

My goal is to help facilitate your financial goals and find the perfect funding solution to lower the overall cost of borrowing. I keep up to date on global economics to sight the trends that might affect the industry, so you don't have to. It’s always exciting to discuss strategies in our evolving economic climate. Times are tough, and with mortgage guidelines continually changing, it can be a challenge to obtain financing, even for someone with excellent credit and net worth!

I have been happily married for over 40 years, and we're proud parents of two children and eight beautiful grandchildren! I enjoy spending time with family, I'm an avid foodie, and enjoy travelling.

Everything you need, all in one place

Know the right mortgage product for your circumstance.

Resources

Looking for some more information? Read through our Blog.